National Electrolytic Copper: A List Of Prices And Inventory Status Of Major Consumption Locations

01> Southern China>

Guangdong area:>

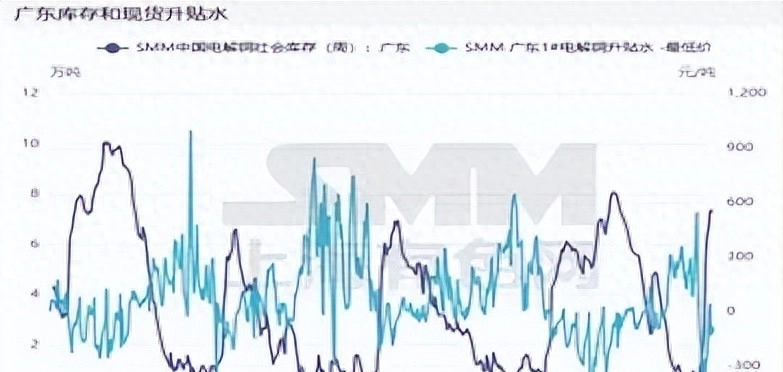

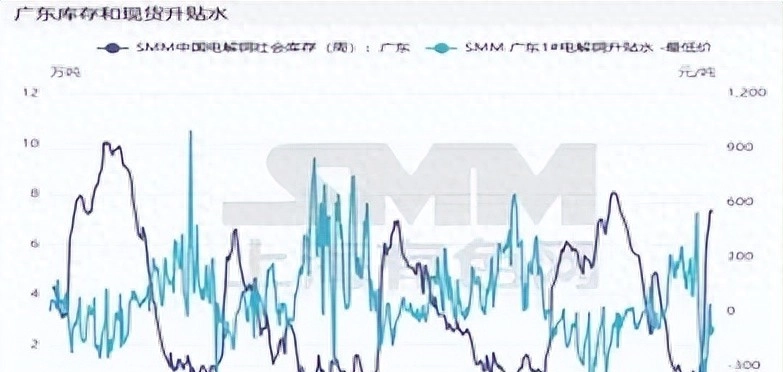

This week, premiums and discounts in the region showed a rise in volatility.> The continued decline in inventory is the main reason for the higher premium.

As of Thursday, the HAO reported a premium of RMB 10/ton, which is 60/ton, which is reported a discount of RMB 70/ton, which is 50/ton, which is 50/ton, which is reported a discount of RMB 150/ton, which is 150/ton, which is 80/ton, which is 80/ton, which is last Thursday, and the supply of wet copper has decreased, and the price has decreased, and the price is lower, and the price difference is high. On Thursday, the price difference between copper discount prices in Guangdong was 60 yuan/ton, and the price difference was small, and there was no room for transfer of goods elsewhere.

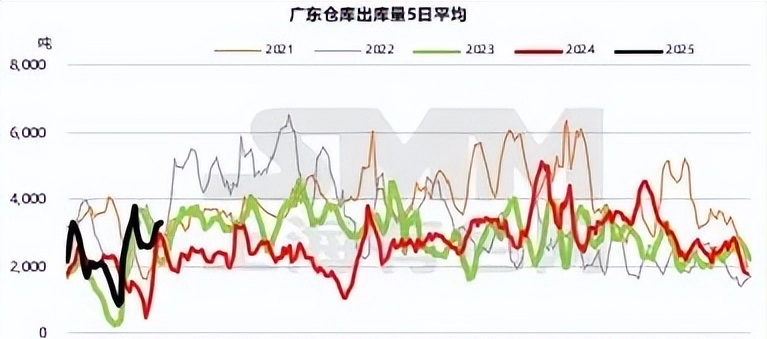

According to our SMM statistics, Guangdong's total inventory as of Thursday was 67,700 tons, a decrease of 5,900 tons from last Thursday, and a decrease of 47,300 tons received by the total warehouse by 4,400 tons. Specifically: this week's arrivals were 10,100 tons per week, down 10,100 tons from last week, below the annual average (14,000 tons per week). Some smelters reportedly organized supply preparations for export supplies, which is one of the reasons for the decline in arrivals. Outbound volume was 16,400 tons per week, higher than the annual average (14,200 tons per week) and decreased. Downstream users can only pick up more items from the warehouse.

Looking forward to next week> As smelters continue to export, the quantity of goods remains low. In terms of consumption, enterprises are sufficiently funded, copper prices fall, and downstream enterprises will purchase more. Therefore, we think there will be some reduction in supply and demand next week and weekly inventory will continue to decline, but this will make the spot premium higher due to the continuous outflow of large warehouse receipts.> .

02> Northern China>

Spot discounts in northern China have been at low levels this week.> As of Thursday this week, the spot discount is 300 yuan/ton-260 yuan/ton, with an average discount of 280 yuan/ton. The overall consumption performance of the northern Chinese market was weak after the Spring Festival, with high inventory of processing companies, and copper prices did not weaken significantly during the week. In addition, as the end of the month approaches, downstream demand is poor. However, it is difficult for holders to accept the current big discount situation. Some commodities are shipped to warehouses in various places, and spot market trading activities are relatively light. March will enter next week, downstream funds will alleviate or resume some demand for replenishment, and the sentiment of merchants holding merchants to maintain prices is getting stronger and stronger. But in terms of consumption, copper prices remain the main decisive factor> .

03> East China>

Copper prices fell this week, and spot traders are optimistic about premiums in March as the end of the month approaches, with spot discounts fusing. As of Thursday, the list of electrolytic copper in mainstream warehouses in Shanghai increased by 12,900 tons to 245,200 tons compared to Monday, while Guangdong and Jiangsu have achieved disasters. Since the structure has been around RMB 100 per ton in recent months, holders hold futures warehouse receipts, while traders mainly trade. Downstream procurement is often a source of low-priced goods, and promotions and discounts are difficult to continue to rise. Looking forward next week, imports will have limited inflows early this month, while supply in Shanghai will still be dominated by futures warehouse receipts and unregistered sources. When the price of copper is below 77,000 yuan/ton, it is expected that the spot discount for Shanghai copper will be reduced.> .

Presumptions and discounts in Shandong continue to run at low levels this week, with little change last week.> As of Thursday, the average price of spot premiums and discounts in Shandong was reported to be a discount of 325 yuan/ton. Specifically, terminal consumption performance is still medium, and downstream purchasing enthusiasm is not high. As the end of the month approaches, holders are under pressure from driving forces and continue to sell at low prices, but overall market trading still shows signs of fatigue, with lower trading activity. The parade will begin next week. Changes in electrolytic copper inventory and the actual performance of downstream consumption will both become factors affecting spot market transactions. Currently, the spot price in Shandong is close to the bottom. According to the recovery rate of consumption, subsequent premiums and discounts are expected to show a slow recovery trend.> .

Source: SMM copper processing and exchange platform . No media or individual can disseminate, publish or copy the original information of Shanghai's non-produced network in any form without authorization. (including but not limited to market data, price information, market statistics information, cnc machining company, research information, etc.) Some content has been changed. If you have any questions, please consult and edit at the end of this article.