National Electrolytic Copper: A Study On The Prices And List Of Major Consumers

01> Southern China>

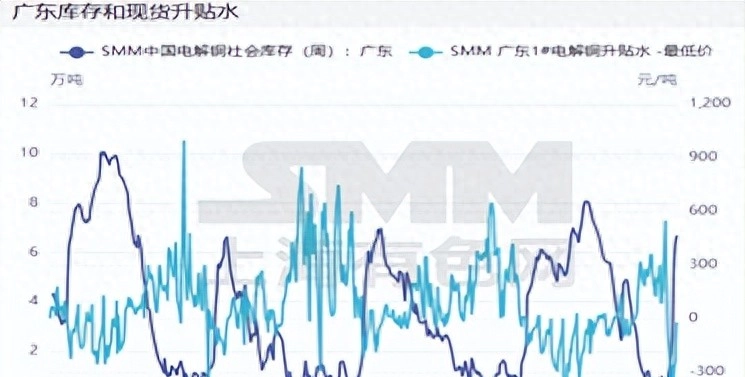

Guangdong area:> This week, premiums and discounts in the region showed a continuous upward trend. With the increase in demand for production of downstream companies, coupled with the newly approved 10,000-ton delivery warehouse of the Shanghai Futures Exchange, the actual source of commodities circulating has increased, which is the above gain. Stimulating, spot premiums rose rapidly.

As of Thursday, HAO reported a 30 yuan/ton increase from last Thursday's 30 yuan/ton cnc shops, reporting a discount of 20 yuan/ton/ton 310 yuan/ton, wet copper As of 100, the price difference between copper and flat copper increased from 270 yuan/ton from last Thursday, the supply of wet copper increased, and the price difference between copper and flat copper expanded. On Thursday, the price difference between copper discounts in Shanghai and Guangdong was 0 yuan per ton, and the price difference was small, and there was no room for other places to transfer goods.

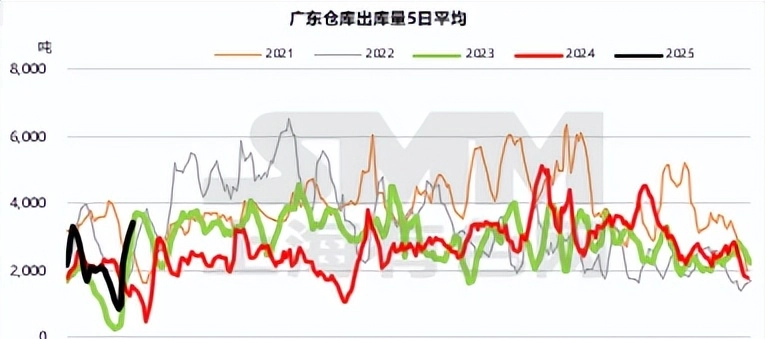

According to our SMM statistics, as of Thursday, Guangdong's total inventory was 66,900 tons, an increase of 14,500 tons from last Thursday, and total warehouse revenue was 33,400 tons, an increase of 13,200 tons from last week.

See details:> Arrivals this week were 29,900 tons per week, well above the annual average (14,000 tons per week). Since the smelter still has a large inventory backlog and the spot quality discount is huge, cargo holders are more inclined to transport goods. Go to the warehouse. Outbound volume is 17,000 tons per week, which is above the annual average (14,200 tons per week). As demand for downstream companies to resume production has also increased, we learned that some copper rod companies have sufficient production this week.

Looking forward to next week> With the delivery path, it is expected that the arrival of warehouses will increase. After the Lantern Festival, downstream enterprises will resume production in full, and the demand for downstream enterprises will continue to increase. Therefore, we believe that supply and demand will be strong next week, and weekly inventory will continue to increase, but the increase will drop compared to last week.

02> Northern China>

Spot discounts in northern China are at a low level this week. As of Thursday this week, the spot discount is 300 yuan/ton-220 yuan/ton, and the average price discount is 260 yuan/ton. Most downstream companies resumed work this week, but consumption was greatly suppressed due to the continued rise in copper price centers after the holidays. After the holiday, copper prices for many downstream companies rose, coupled with high-definition lists of finished products and slow digestion, resulting in weaker buying sentiment.

As the delivery date approaches, the holder is reluctant to lower the price and shipment. Overall, the on-site trading activities during the week were bleak. Monthly redemption delivery will be conducted next week. From the monthly difference structure, spot discounts tend to fall first and then rise, but if copper prices remain strong, market demand is unlikely to increase significantly.

03> East China>

Copper prices rebounded sharply in one week.> On Friday, the Shanghai Copper 2502 contract had exceeded 78,000 yuan/ton, setting a new high since 2025. But as copper prices soared and orders weakened, and on-site buying sentiment also declined.

Observe the monthly difference between Shanghai Copper Futures 2502 and Shanghai Copper Futures 2503 contracts, it will basically fluctuate around rmb/ton cnc machining shops, and holders are obviously willing to support the price level, due to the big discount, very It is difficult to provide room for concessions. In the second half of this week, with the delivery of the Shanghai Copper Value Futures 2502 contract, current warehouse receipts are difficult to match holdings, and given the huge monthly variability on Friday, holders firmly quoted on Friday. Premium.

Next week the spot market will basically enter the quotation of Shanghai Copper Futures 2503 contract.> Although national electrolytic copper stocks are still in stock, domestic smelters may deploy exports to reduce domestic freight, given the export opportunities brought by soaring overseas copper prices, and are expected to stock Shanghai copper in stock before delivery warehouse receipts are fully released. The discount on the value futures 2503 contract is about 100 yuan per ton, so there is almost no room for discount> .

The premiums and discounts in Shandong continue to operate lower this week, and the overall change is not large.> As of Thursday, the average spot discount price in Shandong was reported to be a discount of 240 yuan/ton. Specifically, this year's downstream recovery work is later than usual, with the rise in copper prices suppressing demand and companies are more cautious in purchasing. The overall increase in orders for downstream processing companies this week remains limited. Looking ahead to the future market, terminal demand will continue to recover, but high copper prices will still curb consumption. The rebound in spot premiums and discounts is expected to be limited.> .

Source: SMM copper processing exchange platform. No media or individual can disseminate, publish or copy the original information of Shanghai's non-produced network in any form without authorization. (including but not limited to market data, price information, market statistics information, research information, etc.) Some content has been changed. If you have any questions, please consult and edit at the end of this article.