Main Classifications And Main Characteristics Of Semiconductor Components

(ChinaIT.com News) CIC's integrated circuit semiconductor industry is the core supporting industry for building my country's independent and self-reliant strategic technological strength, and semiconductor components are a key area of the semiconductor industry that determines the high-quality development of my country's industry.

The semiconductor industry is the core supporting industry for building my country's independent and self-reliant strategic scientific and technological strength, and semiconductor components are a key area that determines the high-quality development of my country's semiconductor industry. Although my country's semiconductor industry is currently in a stage of accelerated development, the domestic semiconductor parts industry still faces problems such as low localization rate, insufficient long-term industrial support and investment, weak independent innovation capabilities of enterprises, and weak linkage cooperation between upstream and downstream industries. Talent training and incentive mechanisms are weak. There are many problems such as missing mechanisms.

This article will comprehensively sort out the development characteristics and key enterprises of the global semiconductor component industry, study the domestic and foreign market scale and development pattern, and put forward relevant development suggestions for the main problems currently faced by the domestic semiconductor component industry.

>>>> Introduction

Semiconductor components refer to components that meet semiconductor equipment and technical requirements in terms of materials, structure, process, quality and accuracy, reliability and stability, such as O-ring seals, EFEM (transmission module), RF Gen radio frequency power supply, ESC Electrostatic chuck, Si silicon ring and other structural parts, Pump vacuum pump, MFC gas flow meter, precision bearings, ShowerHead gas nozzle, etc.

Semiconductor devices are composed of thousands of parts. The performance, quality and accuracy of components directly determine the reliability and stability of the equipment. It is also a key basic element for my country's leap to high-end semiconductor manufacturing capabilities. The domestic semiconductor components industry started late. The overall level of my country's semiconductor components industry is low, the supply capacity of high-end products is insufficient, and the problems of poor product reliability, stability, and consistency are becoming increasingly prominent.

In the context of the increasingly complex global macro-political economy and the United States' continued suppression of the rise of my country's high-tech industry strategy, the phenomenon of "trapped" industries has become more prominent. This not only severely restricts the high-end development of my country's semiconductor industry, but also has a negative impact on my country's high-tech industry. The digital economy, people's livelihood economy, and national defense security also bring risks that cannot be underestimated.

>>>>Main classifications and main characteristics of semiconductor components

(1) Main categories of semiconductor components

Semiconductor components are key components of semiconductor equipment. According to incomplete statistics, there is currently no classification standard for semiconductor components in the industry. At present, there are mainly the following classification methods.

According to the internal process flow of a typical integrated circuit equipment cavity, components can be divided into five categories: power supply and radio frequency control, gas transportation, vacuum control, temperature control, and transmission devices. Power supply and RF control categories include RF generators and matchers, DC/AC power supplies, etc. Gas transportation mainly includes flow controllers, pneumatic components, gas filters, etc. The vacuum control category includes various vacuum pumps such as dry pumps. /Cold pump/molecular pump, control valve/swing valve and other valves, pressure gauges, O-ring seals. Temperature control categories include heated plates/electrostatic chucks, heat exchangers, and lifting components. Transmission devices include robotic arms, EFEM, bearings, precision guide rails, stepper motors, etc.

According to the main materials and functions of semiconductor parts, they can be divided into twelve categories, including silicon/silicon carbide parts, quartz parts, ceramic parts, metal parts, graphite parts, plastic parts, vacuum parts and sealing parts, filter parts, moving parts, Electronic control components and other components. Each major category of parts also includes many subdivided products. For example, vacuum components include key components such as vacuum gauges (which measure process vacuum), vacuum pressure gauges, gas flow meters (MFC), vacuum valves, and vacuum pumps. .

According to the service objects of semiconductor parts, semiconductor core parts can be divided into two categories: precision machined parts and general outsourced parts [1]. Precision machined parts are typically designed by engineers at various semiconductor equipment companies and then outsourced for processing. They will only be used on their own company's equipment, such as process rooms, transmission rooms, etc. Localization is relatively easy, and its surface treatment, precision machining and other process technology requirements are relatively high; generally purchased parts are experienced and universal parts that have been widely recognized by many equipment factories and manufacturing plants for a long time and have been proven to be relatively standardized. It will be used by different equipment companies as spare parts and consumables on production lines, such as silicon structural parts, O-ring seals, valves, instruments, pumps, panels, air nozzles, etc. Due to the versatility and consistency of such parts It is relatively strong and requires equipment and production line certification, making localization difficult.

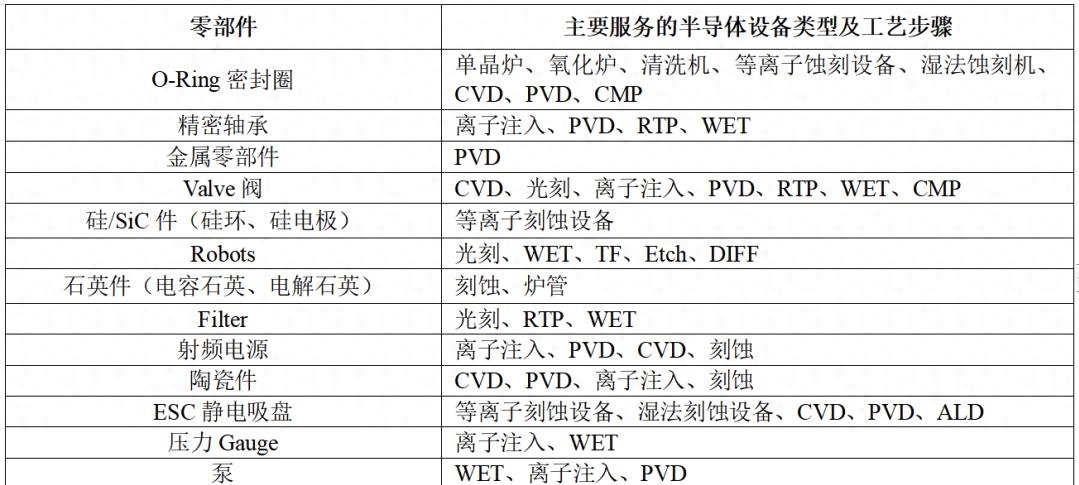

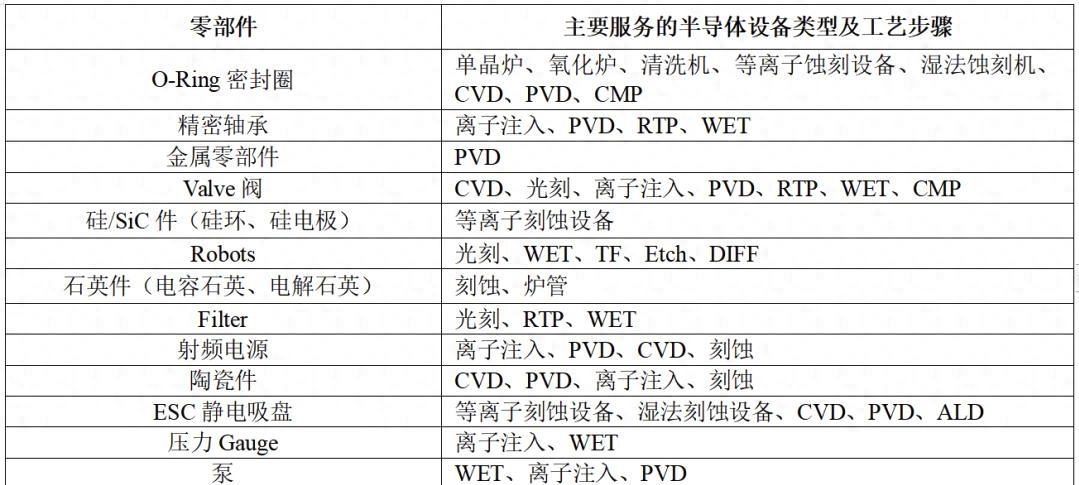

Table 1-1 summarizes the main component products widely used in equipment and production lines, as well as the semiconductor equipment they mainly serve.

Table 1-1. Main components and products and semiconductor equipment for its main services (Source: Compilation of Internet data)

(2) Main characteristics of the semiconductor component industry

The semiconductor component industry is usually characterized by high technology intensity, interdisciplinary integration, small and fragmented market share, but it plays a decisive role in the value chain. Generally speaking, equipment parts account for about 70% of total equipment expenditures. Taking an etching machine as an example, the top ten key components account for 85% of the total equipment cost. It is a key support for the survival and development of the semiconductor industry, and its level directly determines the basic energy level of my country's semiconductor industry innovation.

one. Technology intensive, requiring high precision and reliability.

Compared with basic components in other industries, semiconductor components are particularly complex in terms of cutting-edge technology because they are used in precision semiconductor manufacturing. They have high precision, small batches, many varieties, special sizes, complex processes, and extremely demanding requirements. and other features. Due to the particularity of semiconductor components, companies often have to consider composite functional requirements such as strength, strain, corrosion resistance, electronic performance, electromagnetic performance, material purity, etc. in production.

It is feasible if the same parts are used in traditional industries, but in the semiconductor industry, the purity of raw materials, consistency of raw material batches, quality stability, processing accuracy control, edge chamfering and deburring of key components, and surface roughness There are high requirements in terms of control, special surface treatment, dust-free cleaning, vacuum dust-free packaging, delivery cycle, etc., resulting in extremely high technical threshold.

For example, as the line widths of semiconductor processing become smaller and smaller, the photolithography process has extremely high requirements for the control of extremely small contaminants. Not only the particulate matter is strictly controlled, but also the metal ion precipitation of the filtered products is strictly controlled. This is very important for the production and manufacturing of semiconductor filters. Extremely high demands were made. The current precision requirements for semiconductor-grade filter elements are below 1 nanometer, while other industries require micron-level precision.

At the same time, filters for semiconductors also need to ensure consistency, chemical and thermal resistance, and strong shedding resistance to achieve the repeatable high performance, consistent quality, and ultrapure required in semiconductor manufacturing. Product cleanliness. Demanding.

b. Multi-disciplinary cross-integration puts forward high requirements for compound technical talents.

There are many types of semiconductor components with wide coverage and a long industrial chain. Its R&D, design, manufacturing and application involve interdisciplinary and multi-disciplinary integration of materials, machinery, physics, electronics, precision instruments, etc., so there are opportunities for interdisciplinary talents. The demand is great.

Take, for example, the electrostatic chucks used to hold wafers in place in semiconductor manufacturing. It itself uses alumina ceramics or aluminum nitride ceramics as the main material, but at the same time, other conductive substances need to be added to make its overall resistivity meet functional requirements. This requires a full understanding of the thermal conductivity, wear resistance and hardness indicators of ceramic materials in order to obtain basic raw materials that meet the technical specifications of semiconductor manufacturing; secondly, the internal organic processing structure of the ceramic is manufactured with high precision, and the combination of the ceramic layer and the metal matrix Requirements for uniformity and high strength must be met. Therefore, the structural design and processing of electrostatic chucks require precision processing skills and knowledge; the surface treatment of electrostatic chucks must reach a coating of about 0.01 micron, must be high temperature and wear-resistant, and have a service life of more than three years. Therefore, the requirements for mastering and applying surface treatment technology are also relatively high. It can be seen that compound and cross-type technical talents are the basic guarantee for the semiconductor component industry.

c. Fragmentation characteristics are obvious, and leading international companies mainly focus on cross-industry multi-product line development and merger and acquisition strategies.

Compared with the semiconductor equipment market, the semiconductor parts market is more segmented and has obvious fragmentation characteristics. The market space for a single product is very small and the technical threshold is high. Therefore, there are very few pure semiconductor component companies.

Leading international semiconductor component companies usually focus on cross-industry multi-product line development strategies, and semiconductor components are often just one of the businesses of these large component manufacturers. For example, MKS Instruments holds major market shares in product lines such as barometers/reactors, RF/DC power supplies, vacuum products, and robotic arms. In addition to its applications in the semiconductor industry, it is also widely used in industrial manufacturing, life and health sciences and other fields. and other areas.

Continuous mergers and acquisitions are also the main means for leading international semiconductor component companies to expand their scale. For example, Atlas Copco (Sweden), a leading international industrial equipment company, continues to expand its semiconductor vacuum pump business. Following the acquisition of Edwards in 2014, it acquired Leybold of Germany, a leader in vacuum technology, in 2016, and established an independent vacuum technology department in 2017. In July 2019, Atlas once again acquired Brooks’ cryogenic business. The acquisition includes a cryogenic pump operating company and Brooks in Ulvac Cryogenics Co., Ltd., further enhancing the global competitiveness of its vacuum business in the semiconductor field.

>>>> Semiconductor component market size and development pattern

(1) Global semiconductor component market size and pattern

The global semiconductor components market is mainly divided into two parts according to different service objects. The first is parts and related services customized or purchased by global semiconductor equipment manufacturers. According to data provided by VLSI, the semiconductor equipment subsystem market sales in 2020 will be close to US$10 billion, of which repair + support services account for 46%, component product sales account for 32%, and replacement + upgrades account for 22%.

The second is components and related services purchased directly from global semiconductor manufacturing plants as consumables or spare parts. According to Xinmo data [2], the purchase amount of front-end equipment parts for 8-inch and 12-inch wafer lines in mainland China exceeded US$1 billion in 2020. my country's manufacturing capacity accounts for approximately 12-15% of the world's total. Taking into account the procurement demand for high-value-added components brought about by advanced technology, the global procurement volume of front-end equipment components for 8-inch and 12-inch wafer lines is at least US$10 billion. more than. Therefore, by superimposing the two parts of the semiconductor parts sales market, it can be seen that the global semiconductor parts market scale is in the range of 20 billion to 25 billion US dollars or even larger.

Although the overall size of the semiconductor component market only accounts for less than 5% of the global semiconductor market of nearly US$500 billion, the value of components is usually dozens of times its own price, and it has strong industrial radiation capabilities and influence. In addition, the key technologies of semiconductor components reflect the technical level of a country's industry and semiconductor equipment and have a very important strategic position. Its technological progress is the prerequisite for technological innovation in the downstream digital economy and information application industry.

According to VLSI data [3], the top 10 semiconductor component suppliers in the world in 2020 (see Table 2-1) include Zeiss ZEISS (optical lens), MKS Instruments (MFC, RF power supply, vacuum products), British Edwards (vacuum pump )), Advanced Energy (RF power supply), Horiba (MFC), VAT (vacuum valve), Ichor (modular gas delivery system and other components), Ultra Clean Tech (sealed systems), ASML (optical components) and EBARA (dry pumps).

Table 2-1. Ranking of the world's top ten semiconductor component manufacturers (source: annual reports of each company, online data collection)

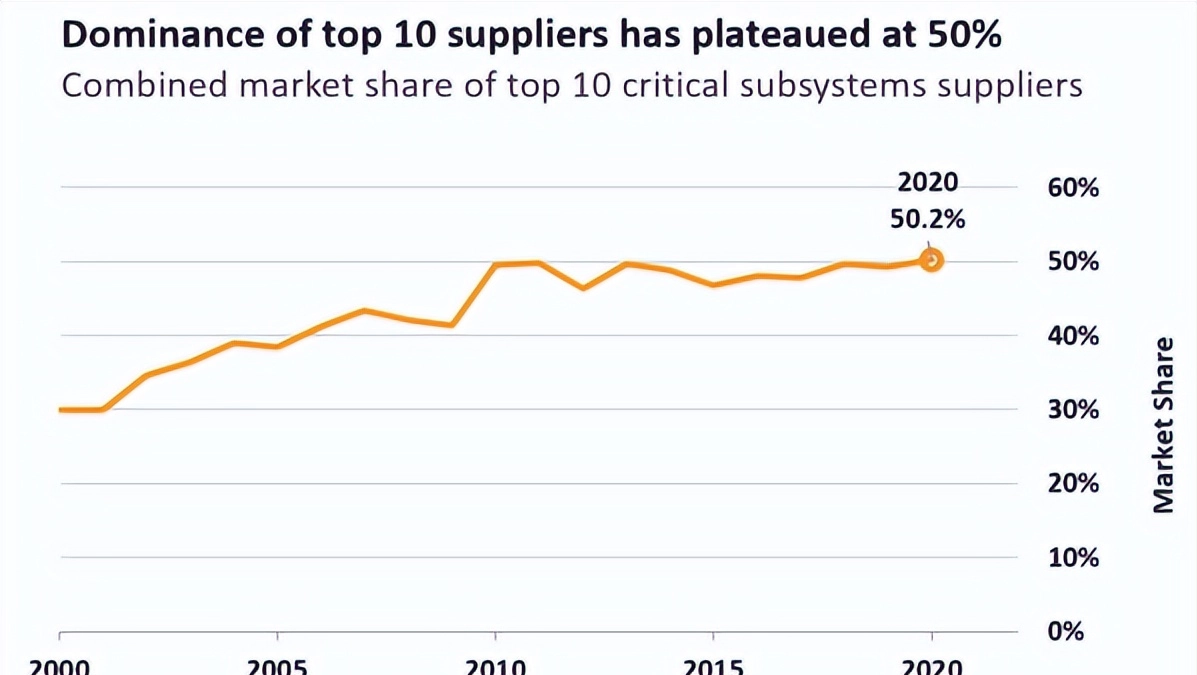

According to the VLSI data in Figure 2-1, the combined market share of the top ten suppliers has remained stable at around 50% over the past 10 years. However, due to the strict requirements for precision and quality of semiconductor components, only a few suppliers in the world can provide products for individual semiconductor components. This also leads to the fact that although the concentration ratio of the entire semiconductor components industry is only 50%, the concentration ratio of sub-categories is often above 80%-90%, and the monopoly effect is more obvious. For example, in the field of electrostatic chucks, American and Japanese semiconductor companies dominate the market (see Table 2-2), with a market share of more than 95%. The main ones include American AMAT (Applied Materials), American LAM (Lin Group), and Japanese companies Shinko (Shinko Electric), TOTO, NTK, etc.

Figure 2-1. The market share of the world's top ten semiconductor component manufacturers has stabilized at around 50% (Source: VLSI)

Table 2-2. List of the world's leading companies in major parts and components (source: Jiangfeng Electronics, compiled from network information)

(2) my country’s semiconductor component market size and pattern

At present, my country's semiconductor component industry is still in its infancy, and the overall scale is small. According to Xinmo data[2], China's local wafer manufacturers (mainly including SMIC, Hua Hong Group, China Resources Microelectronics, Yangtze Memory, etc.) purchased 8-inch and 12-inch front-end equipment parts for approximately US$4.3 billion in 2020. However, due to the rapid expansion of my country's domestic wafer manufacturing capacity, demand for semiconductor components is expected to continue to be strong. According to the existing local wafer manufacturing capacity plan, 50% of capacity will be added by 2023. Based on the calculation of the parts procurement demand for equipment and production lines at the same time, the scale of the domestic semiconductor parts market is expected to exceed 8 billion yuan in 2023 and is expected to exceed 12 billion yuan in 2025.

Despite the rapid growth of the domestic semiconductor component market, the current technical capabilities, process level, product accuracy and reliability of my country's local component companies are far from meeting the needs of domestic equipment and wafer manufacturers, and the overall localization rate is still at a leading level. A relatively high level. Low level. Generally speaking, my country has a relatively high localization rate for custom-designed and produced precision mechanical parts.

Since domestic semiconductor equipment is in its infancy, in order to achieve mass production as soon as possible and catch up with the advanced level, we often adopt the model of designing ourselves and then exporting it to foreign countries (mainly Japan, but also a small amount). Korea) processor to process it. Since the raw materials, processing methods, surface treatment methods, cleaning and packaging of precision processed parts of semiconductor equipment have special requirements, domestic processors are temporarily unable to meet them. In addition, because Japanese processing technology suppliers have relatively rich experience in processing similar parts, some design errors can be discovered and adjusted during the processing process.

Later, as the domestic market gradually expanded, a small number of domestic semiconductor equipment manufacturers began to gradually cultivate processors in other domestic industries in order to reduce costs and ensure supply chain security, and began to devote themselves to the processing of precision components for semiconductor equipment. Therefore, in the field of precision machined parts dominated by equipment manufacturers, domestic parts manufacturers have made rapid progress. However, for general-purpose outsourced parts that are highly standardized and highly dependent on market competition, the localization rate is generally very low. The main reason is that the design and production requirements of these general purchased parts are very high. Even if the samples of domestic products can reach the same level, they still need to work hard to ensure the stability of mass production. At the same time, because domestic equipment companies have just made progress in localization, they are still relatively passive in purchasing common parts and components, mainly focusing on domestic mature products, and are unwilling to rashly try new domestic products [1].

The above are the main reasons why my country is still unable to achieve "independent control" in terms of core products of semiconductor components. According to data from domestic mainstream foundries, there are currently more than 2,000 types of parts (including repair and replacement and fault replacement parts) used in daily operations throughout the year, but the domestic share is only about 8%. The shares of the United States and Japan are 59.7% and 26.7% respectively.

In fact, the high-end parts market is mainly occupied by suppliers from the United States, Japan, and Europe; the mid- to low-end parts market is mainly occupied by Korean and Taiwanese suppliers. Electrostatic chucks are key non-consumable parts in wafer manufacturing plants, with a unit price of tens or even hundreds of thousands of dollars. At present, there is no domestic company that can produce related mature products. Even the aluminum nitride ceramic raw materials used in electrostatic chucks are far from meeting the required technical indicators, and their dependence on foreign countries has reached more than 99%.

In addition, although the scale of my country's vacuum pump industry has reached nearly 200 billion yuan, in terms of dry vacuum pumps for semiconductors, high-end products from companies such as Edwards still need to be imported. However, in recent years, as the domestic semiconductor industry has accelerated new production capacity and expansion, the COVID-19 epidemic has led to disruptions in logistics and transportation services, resulting in continued delays in the delivery of foreign parts and components, accelerating the decline of some domestic semiconductor parts companies with high growth potential in my country. progress. Opportunities for domestic substitution. For example, Jiangfeng Electronics' ShowerHead and cavity processing business, Cobetter's filter business, Tongjia Hongrui's dry vacuum pump business, etc. Table 2-3 summarizes some of my country’s companies in different semiconductor component fields.

Table 2-3. Major domestic semiconductor component companies (Source: Compilation of network information)

>>>>Main problems faced by the localization of semiconductor components

(1) Parts and components are not paid enough attention and industrial support policies are not in place.

The total scale of the semiconductor component industry reaches billions. Compared with the core semiconductor industry chain, the scale is small. There are many product varieties and specifications, few leading companies, low industrial concentration, and scattered technical problems. So it's been a problem for a long time. Not getting enough attention.

Since 2014, my country has elevated the development of the semiconductor industry to a national strategy. Subsequently, at least more than 30 local governments introduced support policies to promote the development of the semiconductor industry [9]. However, whether at the national or local level, policies focus more on design, manufacturing, packaging and testing, equipment and materials, etc., and rarely involve the semiconductor component industry.

In terms of funding, parts and components companies rarely receive capital support. The National Integrated Circuit Industry Investment Fund currently invests a small proportion in the field of semiconductor components, with an investment amount of less than 100 million yuan. As of the end of 2020, the total market value of listed parts companies with semiconductor parts as their main business (less than 30 billion yuan) accounted for only 1% of the total market value of the entire semiconductor industry chain companies (more than 3 companies). trillion yuan).

(2) Innovation capabilities are relatively backward, and the core technology gap is obvious

Since the parts industry has not received much attention for a long time and can only grow in an extensive manner, most domestic parts companies enter the semiconductor industry mainly to provide repair and replacement services and cleaning services. The overall R&D investment is insufficient and innovation capabilities are relatively backward. For a long time, it has stayed at the low-end production standard level, copied foreign products, and the core technology gap is obvious.

According to the prospectus of a domestic listed semiconductor component company, its total number of R&D personnel is only 15. The total R&D investment from 2016 to 2018 was less than 20 million yuan, and the average annual R&D investment intensity was less than 5%. In addition, the lack of innovation capabilities of my country's semiconductor component industry is also reflected in many problems such as imperfect industry standard systems, serious lack of investment in basic process research, poor access to process technology, and loose integration of science and technology. Research and production practices, which limit semiconductor component products. Innovative development of structural design technology, reliability technology, manufacturing technology and process, and basic material performance research.

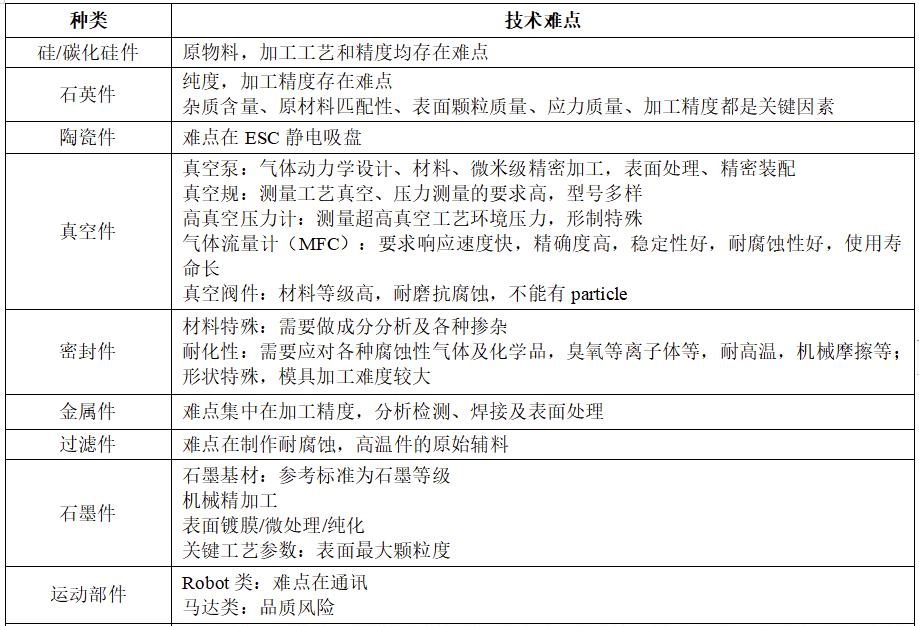

Table 2-4. Technical difficulties of major domestic semiconductor components (Source: SMIC[4], Jiangfeng Electronics[6], network information compilation)

(3) Insufficient supply of craftsman talents and lack of effective incentive mechanism

At present, the talent gap in my country's semiconductor industry reaches hundreds of thousands. Although my country has introduced a series of support measures for semiconductor talent training in recent years, a large number of semiconductor talent training is mainly concentrated in the design, manufacturing, equipment and materials links. Basic industries such as semiconductor components do not pay enough attention to talent training. There is a lack of overall planning and implementation efforts in education system reform, professional establishment, in-service engineering education, and basic subject technical qualification certification. There is a serious lack of basic parts and professional skills courses. At the same time, there is still a lack of advocating refinement, truth-seeking, and innovation. , guided by the spirit of craftsman who is good at designing and solving problems [5].

In addition, the semiconductor component industry also faces the serious problem of insufficient talent incentive mechanisms. Although the overall salary level of domestic semiconductor industry personnel has increased significantly compared with before, for the machining, precision instrumentation, surface treatment and other industries required by parts and components companies, employee salaries are generally far lower than the average level of the company. Semiconductor industry. According to the prospectus of a domestic semiconductor component company, it had only 15 R&D personnel before listing. The annual salary of core technical personnel is only 75,000, and the annual salary of ordinary R&D personnel is only 30,000. Low salary levels have led to serious brain drain in semiconductor parts companies, leaving the basic parts industry with no successors and falling into a vicious cycle.

(4) All links in the industrial chain are disconnected, and upstream support capabilities are insufficient.

Semiconductor components need to go through strict and complex verification procedures before they can be verified through mass production lines and achieve large-scale sales. Therefore, parts manufacturers need to fully collaborate with downstream equipment and manufacturers.

At present, the online verification procedures for domestic semiconductor components are complex and lengthy. The degree of cooperation between manufacturers, equipment manufacturers and domestic semiconductor component manufacturers is not high, and there is a lack of effective communication and interaction. As a result, both parties do not understand each other's process parameters and supporting facilities. Domestic substitution capacity is insufficient. In addition, in the long-term product iteration process, existing foreign parts manufacturers have formed a large amount of Know-How (technical know-how).

In the subsequent imitation and trial production process, domestic manufacturers can usually only achieve a similar appearance. Due to lack of experience and key technologies, they were eliminated in preliminary verification and unable to enter large-scale applications [5]. In addition, domestic semiconductor component manufacturers are unable to obtain support from raw materials, production equipment and other supporting links, which also affects the competitiveness of their products.

Semiconductor parts are generally multi-variety products with high processing accuracy requirements. The raw materials and processing equipment to produce these parts are demanding and expensive. As our country's industry has long been affected by the mentality of "emphasis on the host machine and light on supporting components", there has been a serious lack of investment in the upstream and downstream supporting fields of parts and components, resulting in a serious lack of investment in the upstream and downstream supporting fields of parts and components in our country, resulting in a gap in the development of our country's parts and components industry. There is a big gap between parts, raw materials, production equipment and other aspects compared with foreign countries. For example, in the high-precision machining centers currently commonly used for semiconductor metal parts, my country lags behind foreign countries in terms of processing accuracy, processing stability, and geometric flexibility.

Another example is aluminum alloy metal, tungsten and molybdenum metal, the raw materials for manufacturing high-end metal parts, and high-purity quartz sand raw materials, the upstream raw materials for quartz parts, which are basically monopolized by American and Japanese companies. The monopoly supply of raw materials restricts downstream material producers/processors/users. Mainstream quartz glass materials (tube/rod/iron) basically come from American, German, and Japanese companies.

Insufficient upstream processing equipment and raw materials have resulted in most of my country's semiconductor component companies operating at a low-tech level for a long time. The level of raw materials and process equipment is not high, and advanced equipment is lacking and incomparable. The consistency of product quality cannot be guaranteed, which affects the improvement of product quality.

(5) Certain manufacturing conditions are restricted, which will affect the upgrade of high-end products.

Since semiconductor manufacturing processes often occur at high temperatures and in highly corrosive environments, more than half of semiconductor parts require surface treatment to improve their corrosion resistance. For example, the plasma etching chamber of semiconductor etching equipment has a high-density, highly corrosive and highly active plasma environment. The chamber and its components are highly susceptible to plasma corrosion. In order to extend the service life of these components, they are often used on the surface of alumina-based materials (aluminum and aluminum alloys), which can effectively reduce plasma corrosion of chambers and other aluminum-based materials.

Our country's increasingly stringent environmental protection requirements have restricted the development of most surface treatment technologies, such as sandblasting, spraying, electroplating, anodizing, etc., which has led to some high-end surface treatment processes, such as micro-arc oxidation, high-end spraying and Y2O3 ceramic coatings. etc. There is always a big gap in China, which also directly affects the performance and quality of component products, including valves, showers, ceramics and other components. Although Chinese manufacturers can shape them according to drawings, their development is fundamentally limited because They cannot solve the problems of materials and surface treatment. In addition, certain cutting-edge technologies for semiconductor components are subject to an "embargo." Domestic companies lack drawings and precise data and are unable to develop into mid-to-high-end technologies. For example, there is always a need for low pressure vacuum gauges produced by MKS USA. You must apply for an export license before purchasing[6].

>>>>Suggestions on developing China’s semiconductor component industry

(1) Pay attention to top design and guide industrial development

The field of semiconductor components is a key "stuck" link that has long been heavily dependent on advanced countries such as the United States and Japan, and requires greater attention to top-notch design. It is recommended to determine the development of the semiconductor component industry by formulating special plans, plans or roadmaps, and to formulate appropriate policies and plans based on domestic and foreign development conditions in different periods to guide appropriate policies and plans to guide appropriate policies and The plan to develop the industry in an orderly manner also makes society as a whole, especially market-oriented capital, very important to the semiconductor component industry.

(2) Establish special industrial projects to stimulate innovation vitality

In order to achieve rapid development and prosperity of the semiconductor component industry, the most basic thing is to enhance the ability of independent innovation. Currently, in the field of semiconductor components, our country only relies on imitation and tracking technology, and it is no longer possible to fully guarantee the semiconductor supply chain. Transcendence can only be achieved through independent innovation. Although some parts and components companies were supported in the 02 Special Project [7], further efforts need to be strengthened. It is recommended to establish a separate special project for the semiconductor component industry in the national science and technology plan and cooperate with leading domestic semiconductor component companies to prepare for the establishment of a national component technology innovation platform or research institute, collect superior forces to target breakthroughs and main directions, and comply with Independent innovation, research and development, and focus on overcoming many key core technologies of the basic components of industry, and establish a technological innovation system with enterprises, as the main body and joint industry, academia and research, and guide cutting-edge research and development from the country technologies in the field of semiconductor components, basic technologies and key general technologies.

(3) Fill policy gaps and strengthen investment guidance

The semiconductor parts industry is an industry with sufficient market competition. Domestic parts companies are small in scale, have large quantities, and have thin product margins. Their R&D investment in new products and technologies cannot be compared with that of large international companies. It is difficult to win simply by relying on market competition. However, in the current international geopolitical context, the government needs to implement relevant special policies to provide guidance and support to help domestic semiconductor component companies develop rapidly.

It is recommended that major products independently developed by domestic semiconductor component companies be provided with post-subsidies and national financial and local financial support. The intellectual property rights of independently designed products should be strengthened, and semiconductor component products should be included in the first group of government procurement catalogs. Encourage various domestic industrial funds and socialized capital to actively invest in semiconductor parts companies, and assist the development of domestic semiconductor parts companies through the capital market.

(4) Increase talent introduction and training and strengthen talent supply

Comprehensively strengthen the training and introduction of engineering, scientific research, and comprehensive talents in fields related to semiconductor components [8]. Encourage large scientific research institutions to establish graduate education and postdoctoral workstations in the direction of semiconductor components, and rely on major national engineering projects and major science and technology projects to cultivate leading talents in semiconductor component engineering science and technology.

Advocate for enterprises, schools and scientific research institutions to jointly conduct vocational education and on-the-job training, actively promote the school-enterprise cooperation model to jointly cultivate skilled talents, and conduct large-scale training, centralized training, directional training or training for the semiconductor industry through order education Commissioned training between schools and businesses. component technical capabilities and strengthen the supply of talent. We will use various methods to actively introduce overseas engineering technology leaders and in-demand talents, encourage local governments to introduce talent policies for core technology skeletons, and lead entrepreneurs in the field of semiconductor components, continuously improve talent incentive mechanisms, and stimulate its performance industry develop.

(5) Promote machine parts linkage to ensure independent supply

Promote the "mechanical connection" of the essential semiconductor supply chain and completely reverse the disconnect between component products, equipment and manufacturing. Through government guidance, domestic wafer factories and equipment factories are encouraged to effectively play the role of organizing and coordinating large-scale production lines, and coordinate with local component manufacturers to strengthen cooperation in the industry chain through various methods to achieve coordination of mainframes and basic components. development.

Support semiconductor manufacturing or equipment engineering projects led by national or local government investment, prioritize domestic semiconductor component product verification opportunities, and provide certain risk subsidies. Encourage equipment parts manufacturers in the fields of machinery, electronic products, chemicals and other fields to actively expand and expand their semiconductor business, develop high-end products to meet the needs of semiconductor equipment based on their own technology base, and further consolidate and improve product layout and enhance the independence of domestic parts and components supply capabilities.