After The Tariff Investigation, What Changes Will Happen To The US Copper Market In 2025?

The tariff policy on US electrolytic copper imports is facing a critical turning point.> Although no additional tariffs have been imposed, the Trump administration's investigation has sparked strong expectations under the 1962 Trade Expansion Act investigation> .

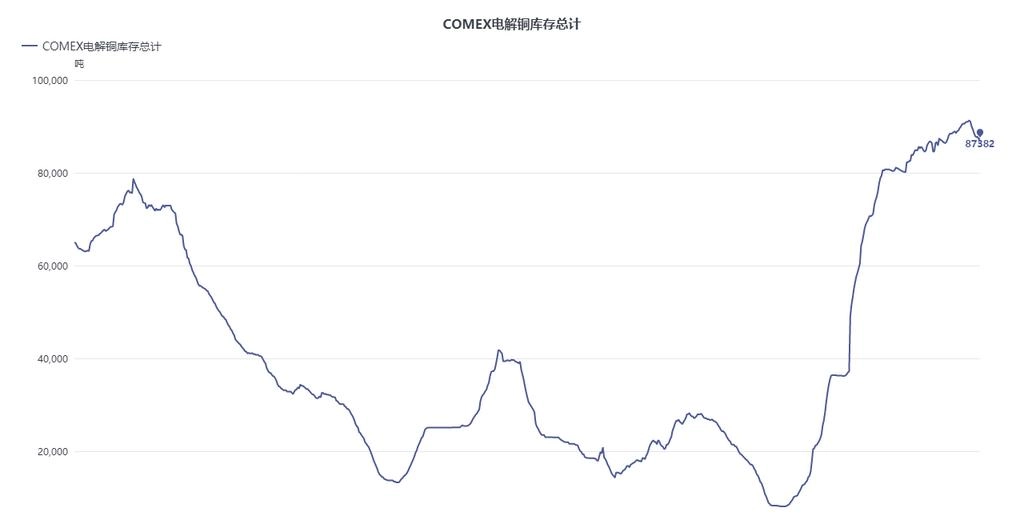

The core logic of this policy is to fill the structural gap in the domestic supply chain in the United States. The current copper price difference between LME and COMEX lays the foundation for global trade flows.> The price difference between the LME 3 million contract and the major COMEX contract has once again expanded to around $900-1,000/ton after the Trump administration’s tariff investigation into copper, which is expected to last for a long time before the tariffs are implemented.

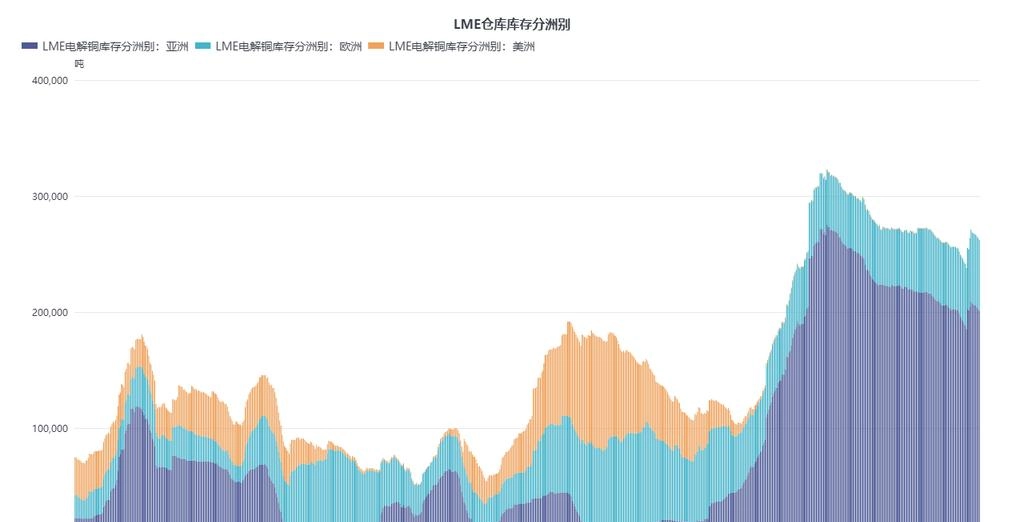

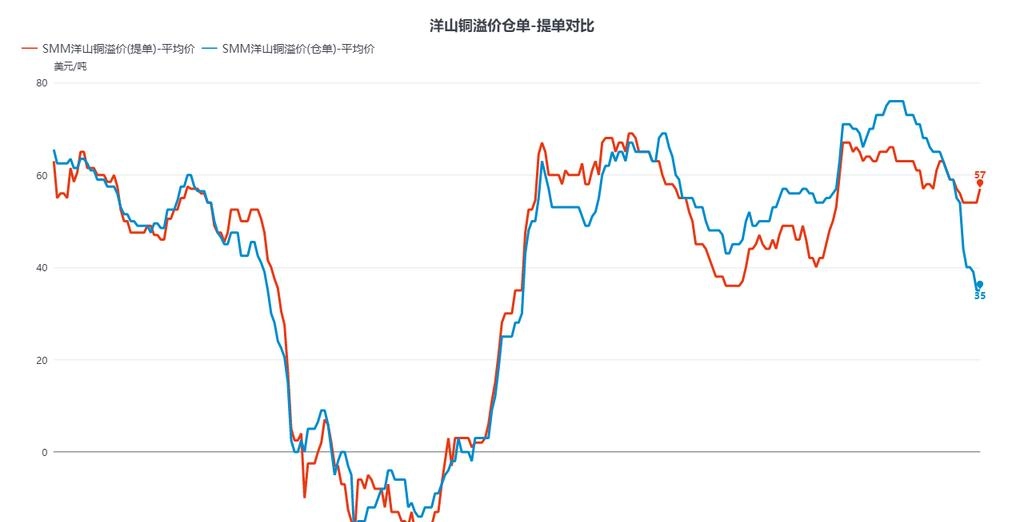

Affected by this, LME canceled warehouse receipts at about 30%, and the structure in recent months has also changed from about/ton to about USD/ton last month. Focusing on the drastic changes in tariffs and foreign market structures, the following are speculations about changes in spot trade flows in the US copper market in 2025.

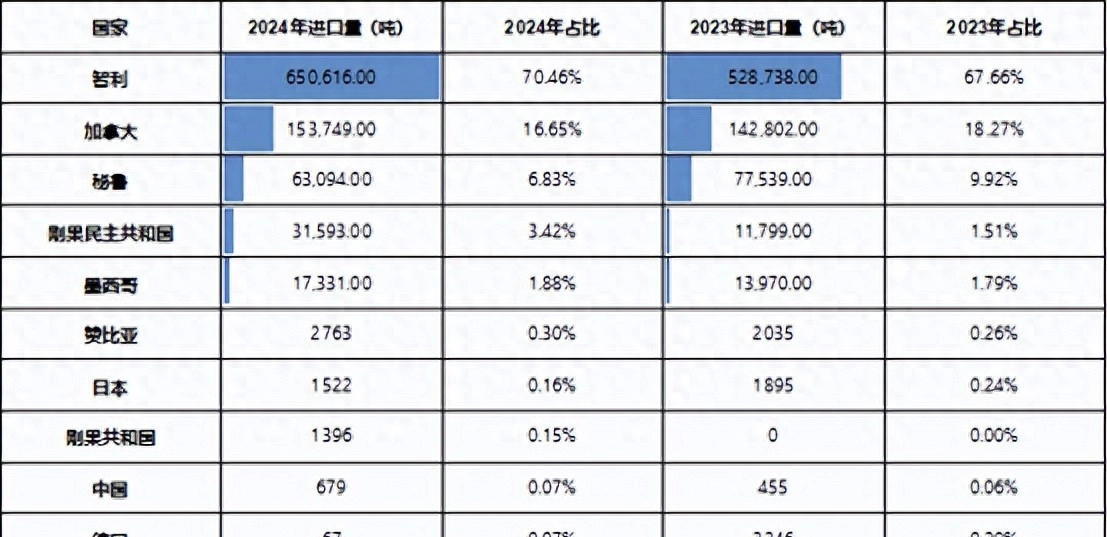

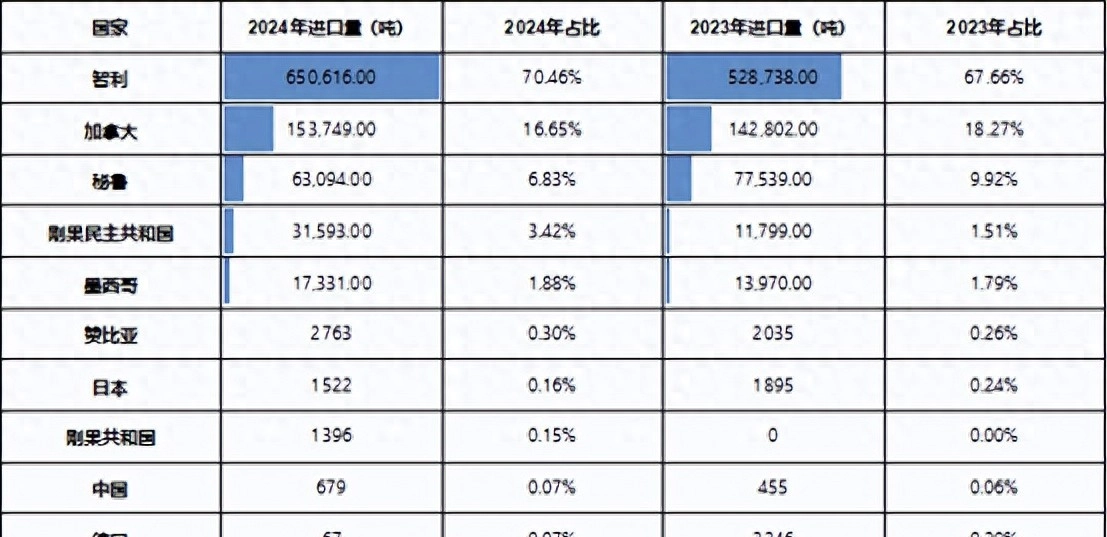

On the one hand , from the perspective of the United States> The United States consumes about 16,000 to 1,700,000 tonnes of electrolytic copper every year, but its domestic electrolytic copper production is only 800,000 to 900,000 tons, about 50% of it depends on imports. Among them, Chile became the largest supplier with a share of 70%, and Canada relies on the North American Free Trade Agreement to form regional resupply with a share of 17%.

The current cost of electrolytic copper transportation from LME Asia shipping warehouse to the United States registered as a COMEX warehouse is about $400/ton, with an operating period of about 35-60 days, and a shipping cost from Europe to North America is about $250/ton, with an operating period of about 20-35 days. The shipping cost from Africa to North America is about US$300/ton, with a time of 25-40 days. (Costs will fluctuate due to logistics and destination)

But in reality, congestion in ports and inland transportation costs in the eastern U.S. has swallowed up 30% of the price difference.> The tariffs on electrolytic copper sources in China will generate 3% trade tariffs and 10% punitive tariffs, and the tariff ranges on electrolytic copper sources in Japan will generate 1% trade tariffs. This basically eliminates the possibility of household electrolytic copper and Japanese copper> .

At present, trade flows from Asia to North America are mainly short-term speculation> , If the timeline is extended, North America's dependence on electrolytic copper in South America, Africa and Australia will continue to increase. The huge arbitrage space before the implementation of tariffs also led traders to prefer to allocate more sources of goods to North America> , thereby increasing trade in the Americas end.

On the other hand, the benefits of spreading arbitrage will also reduce China's short-term import copper inflow, increasing the tension of China's copper coins .> . In the Asia-Pacific region, China has formed a supply network relatively independent of the Americas through resource countries such as the Democratic Republic of the Congo, Kazakhstan and Russia.

Since the end of 2024, the import volume of electrolytic copper from South America to China has dropped significantly, while the price of long-term orders in 2025 has further reduced the proportion of long-term orders for long-term copper imported by South America. Not enough to import copper concentrate> In 2025, the flow of major copper-consuming areas formed in the Asia-Pacific region will also be more closed.

At the same time, due to the conversion of the LME structure into the back, the cost of capital held by marine trade has increased significantly. According to the SOFR rate, the capital cost generated by a ton of electrolytic copper is about US$1.5-1.6/ton/day. Without the cost convenience brought by the LME deep structure, marine trade activity for long-term orders is expected to decline. There is no doubt that the African region will become one of the most important resource competition sites under copper tension.

Return to the domestic imported copper market> In the short term, due to relatively weak prices and import expectations, under capital cost pressure, the price difference between nearly marine and oceanic commodities and the brand attributes of electrolytic copper from different origins have increased the price elasticity of the US copper market in the short term. However, from the current known situation, the Philippines' Passar smelter has stopped production and it is difficult for Indonesian projects to produce copper by the third quarter. In addition, conventional maintenance of smelters and reduced ocean trade volumes in March cnc machining companies, which is a defined conclusion that opposite import supply is the opposite. The premium of imported copper CIFs is easy to rise, but it is difficult to drop from the second quarter of 2025.>

In short, Adjusting US electrolytic copper tariff policy is driving accelerated differentiation in global trade patterns> . The price gap between COMEX and LME continues to widen, thus promoting the formation of a split supply chain system between the Americas and the Asia-Pacific.

Short term> Cross-regional arbitrage is limited by logistics bottlenecks and tariff costs, and the ever-decreasing smelting capacity has further exacerbated the supply contradictions in the Asia-Pacific region. In the long run,> Regional barriers and resource competition have become the core of pricing. In this process, the weight of supply chain security and geopolitical games will become one of the main factors in the new round of market changes.>

Source: SMM Copper Processing Exchange Platform, Author: CI. No media or individual can disseminate, publish or copy the original information of Shanghai's non-produced network in any form without authorization. (including but not limited to market data, price information, market statistics information, research information, etc.) Some content has been changed. If you have any questions, please consult and edit at the end of this article.